A closer look on USDA Rural Development Mortgage

Do the thought of residing in the nation or suburbs focus to you personally? Think about to shop for a home and no currency off? Which have an effective USDA Rural Innovation loan, can help you one another!

USDA (RD) mortgages was government recognized money. The borrowed funds try financed otherwise began of the a loan provider (instance MiMutual Home loan) but enjoys a guarantee about All of us Company out of Farming Rural Invention (USDA RD). Therefore be certain that, there is less chance for the lender, ergo making it possible for far more good financing conditions into the debtor.

No Down-payment:

Probably the best advantageous asset of a great USDA RD loan is the down-payment demands. Today, a lot of people struggle to set aside a good deal away from coupons. In most cases, saving upwards getting a deposit are cited among the most significant traps in order to homeownership.

Versatile Borrowing from the bank Criteria:

USDA RD loans do have more lenient credit requirements and you will personal bankruptcy assistance in comparison with conventional loans. Because the USDA by itself doesn’t place a minimum credit rating, loan providers set their unique minimums. Of numerous lenders wanted a get with a minimum of 640. MiMutual Mortgage, but not, allows fico scores as low as 580, making it loan system a option for consumers having faster-than-finest borrowing from the bank histories. That it independence opens opportunities for those who might have came across financial challenges previously.

Lower costs

USDA RD funds give you the most affordable home paydayloanalabama.com/shiloh/ loan insurance premiums whenever as compared to most other mortgage software. Both initial home loan advanced (MIP) together with yearly mortgage insurance policy is inexpensive than is you’ll need for FHA money. The brand new RD MIP along with always cost a lower amount than simply old-fashioned Private Home loan Insurance (PMI).

On top of that, not all of your own settlement costs need emerge from pouch. Your settlement costs are shielded using supplier concessions (up to 6% of one’s purchase price) or by way of offers, gift funds, otherwise county Down payment Advice (DPA) applications.

Not only for purchase:

MiMutual Mortgage also offers USDA RD financing for to shop for or refinancing property. Whether or not you purchase or refi, licensed consumers are eligible getting 100% investment. The newest RD Improve system makes you re-finance your existing RD mortgage without difficulty! Once the label ways, the procedure is a quicker, smooth process that waives the newest termite, better, and you can septic inspections. No the new appraisal becomes necessary!

Service for Rural and Suburban Portion:

USDA RD money are especially built to assistance outlying and you can suburban groups. That it means some body residing in these types of areas get access to reasonable money solutions when you are promoting financial innovation and you can balance.

Very, now that we talked about the advantages of this new RD loan, lets look closer at a number of the qualifications criteria:

Discover money guidance

You don’t have to be a first-day house consumer, however do need to meet certain money advice. RD funds indicate that a debtor do not go beyond 115% of its regional median household money. To see the current earnings qualification limits, visit the USDA RD website in the:

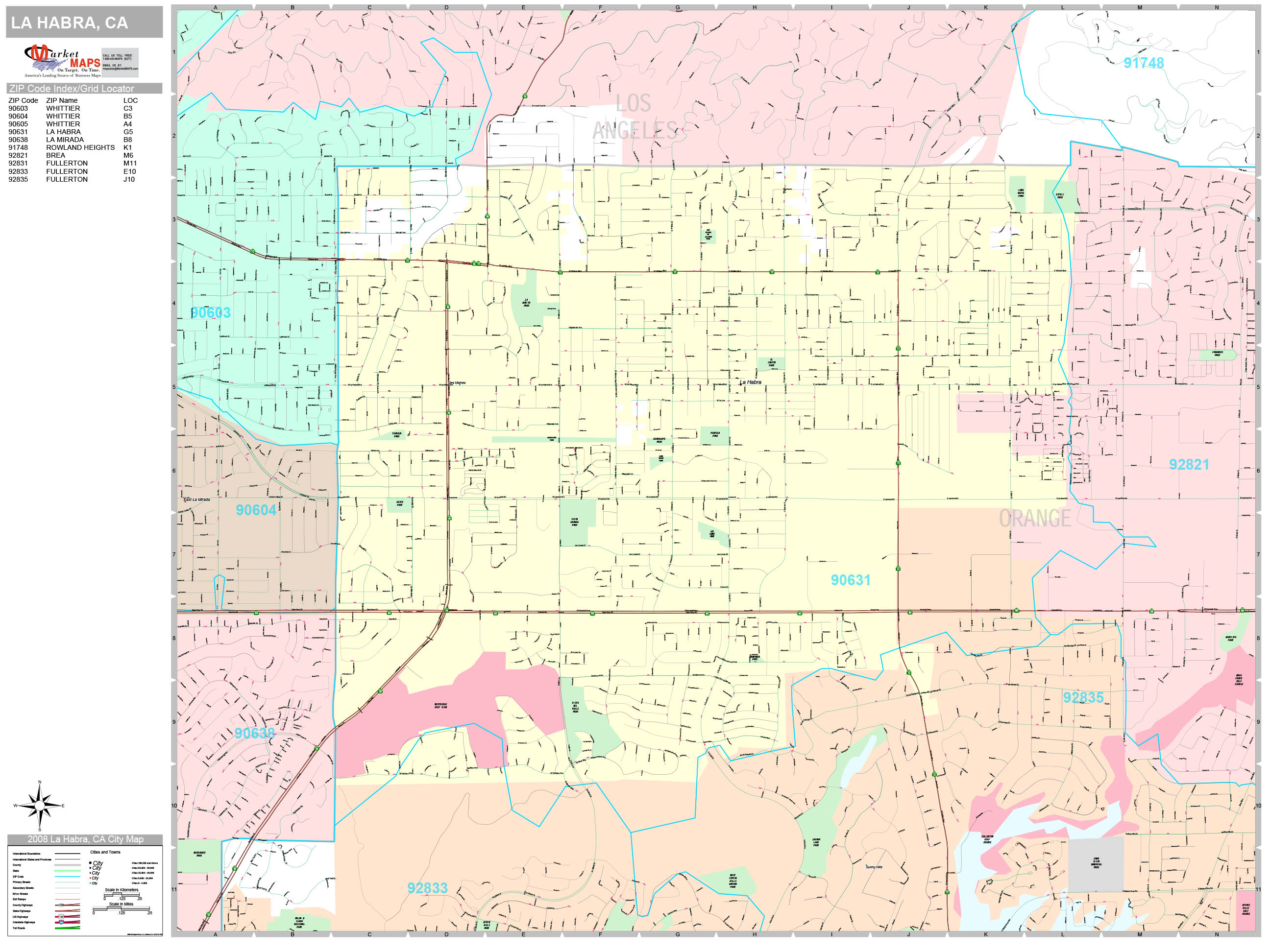

The house have to be situated in an outlying city

You will be wanting to know, what is felt outlying? There are a selection out-of significance as to what constitutes good rural area versus a metropolitan or metro town and this is also lead to frustration on an excellent property’s program qualifications. Although many anyone think of secluded, dirty county ways when they thought rural, you’re astonished at just how many properties have been in a USDA discussed rural’ town. Inhabitants, geographic isolation, and the regional work markets are factors thought.

The best way to determine if your home is within the a good USDA designated outlying area is to try to look at the program’s qualification chart within: Click!

Loan words, restrictions, and qualified property systems

In lieu of a traditional or FHA mortgage, USDA cannot place an optimum mortgage amount for RD funds. With no limit sales speed, this might open your options. However, RD financing are just offered given that a 30-seasons repaired mortgage, and once more, have to be based in a place defined as outlying.

Eligible possessions sizes were single relatives homes, PUDs, the fresh structure (recognized as below 12 months old having Certificate from Occupancy),short sales and foreclosed belongings, web site condos and you may current manufactured house eligible for the new Are produced Household Pilot System (certain condition qualifications limitations pertain).

Attributes perhaps not eligible for RD capital tend to be people who is income-producing, below construction, located in an urban area and you may/or not considered because pretty good, as well as sanitary (DSS) because of the USDA standards. DSS conditions in short, make sure the residence is structurally safe, and you may all things in an effective doing work purchase. If the a property isnt conference DSS standards, it must be listed in a beneficial repair just before investment or towards the mortgage loans.

Perhaps you have realized, USDA RD funds are a good alternative if you are looking to live on off the beaten roadway and require 100% funding that have Zero off. Very, while you are Installed and operating Rural, we are ready to let get you around!