Owner-Repaid Rates Buydown: Your Secret Gun During the A leading-Price Environment

In the a current blog post, i discussed the latest particulars of financial circumstances (otherwise discount products) and you can if it is practical to spend these to reduce steadily the interest on the mortgage.

While the interest rates continue steadily to go up, these types of buydowns are receiving a lot more of a topic away from dialogue certainly one of home buyers and you will sellers, in addition to their representatives and you will loan providers.

Of these people who had been to your cusp out of qualifying to possess a mortgage in the first place, rising cost you may enchantment disaster and give a wide berth to all of them regarding having the amount of funding needed seriously to buy a home.

This can plus be an issue for manufacturers. Considering a recent article because of the Financial Information Every day, real estate loan software only struck the lowest accounts within the twenty-two age.

Regardless of if we have been however theoretically into the a beneficial seller’s sector (a lot more need for house than simply also have), new tides was modifying. Fewer customers capable qualify for mortgage financial support means less buyers putting in a bid towards the home. For those who are in a rush to sell, this may mean having to reduce the cost of our home to draw qualified people.

Neither people neither vendors profit whenever interest rates go up such the audience is seeing now. Yet not, there clearly was an easy method for your mortgage and you can real estate cluster be effective to one another to help make a win/Earn circumstances for everybody in it the vendor-Paid Speed Buydown.

What is A provider-Paid off Speed Buydown?

Loan providers allow provider of a home to help you credit a portion of its proceeds with the domestic client. That is entitled a merchant concession. Seller concessions can be used to pay a client’s settlement costs only, and cannot be employed to help with the newest deposit.

Just what experienced home loan and real estate agents understand is that vendor concessions could also be used to spend mortgage situations and get along the rate of interest.

The entire tip towards provider-repaid rate buydown is to find cash return regarding the seller to https://simplycashadvance.net/loans/emergency-loans-for-bad-credit/ help you permanently buy down the interest rate. Most agencies and you can financial positives commonly distributed the vendor financing in order to underwriting will set you back, escrow fees, and you may mortgage fees…very few of these think to permanently get on the focus rates towards the loan and this reduces the brand new month-to-month homeloan payment.

Which Benefits from A vendor-Paid back Rate Buydown?

In a consistent seller’s sector, in which you will find usually multiple also offers on the home and you can biddings battles is the norm, then it true. But once we in the above list, rising interest levels is actually throttling affordability and ultimately causing less financial programs specifically for highest-cost property.

If this is the case, the fresh new go-in order to solution is with the vendor to attenuate the fresh asking price of the house. But this is certainly not how you can wade. A provider-paid off speed buydown will in fact produce a great deal more funds for both the buyer In addition to provider.

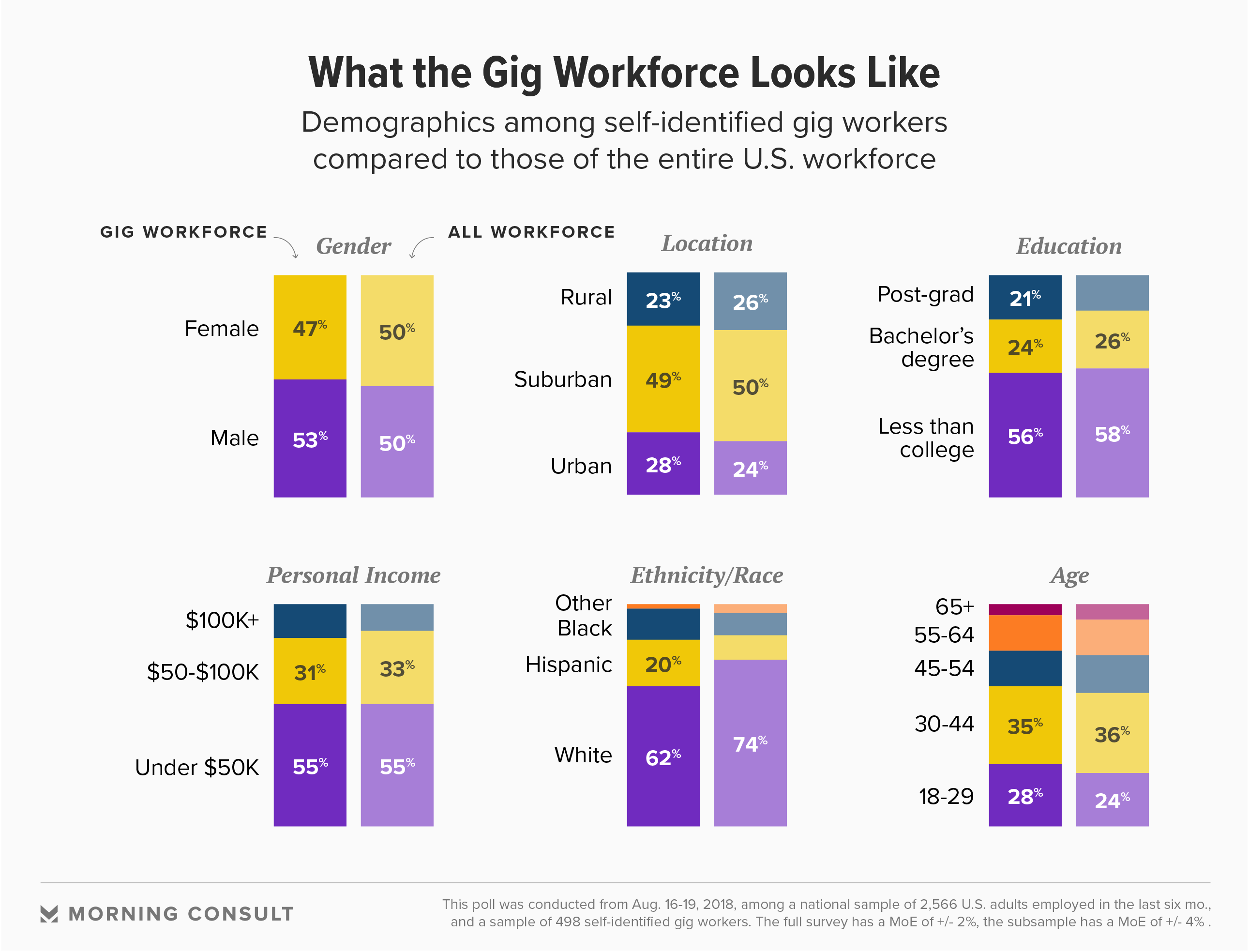

Less than try an example from that loan research showing alternatives for buying good $500,000 family using a thirty-seasons repaired-rate financial on a good 5.5% rate of interest.

Because of it analogy, imagine if the buyer can just only qualify for an excellent payment per month out of $step three,000. Perhaps you have realized in the first line demonstrating the marketplace price and speed, the buyer would not be in a position to spend the money for domestic during the which situation.

Rates Prevention Approach

It alter do produce specific savings into the visitors, however the requisite payment per month do remain way too high. This strategy would slow down the seller’s internet gain $20,000 a considerable amount.

Seller-Paid Rate Buydown Means

Now see what might takes place in case your seller paid off 2 things to purchase along the interest of the .5%.

Not simply create that one reduce the payment per month adequate to just what visitors you will qualify for, it could can also increase this new seller’s online gain $ten,500 compared to the price prevention strategy.

For taking it one step then, the last line suggests just how much the seller manage currently have to minimize the cost of the house to reach an equivalent payment per month since speed buydown method $twenty seven,270, that’s nearly three times the price!

And finally, by reducing the pace, the customer have a tendency to see so much more offers across the lifetime of its mortgage not merely initial.

The conclusion

Transactions regarding the price and seller concessions are included in all actual estate deal. Just what of many don’t understand would be the fact a merchant-paid down rate buydown method also offers way more benefits for everybody activities on it fundamentally:

- Giving a not as much as-sector interest rate to your property usually entice significantly more consumers

- Preserves the seller currency initial

- Preserves the consumer profit the long run that have all the way down repayments and you can a lower life expectancy interest

- Facilitate keep home values to your city

- Hinders the stigma of a price reduction

If you like for more information on the benefits of a supplier-paid down speed buydown means, or if you desires to find financing analysis similar toward one to a lot more than for the sort of buy circumstances, submit the shape lower than in order to consult a mortgage discovery visit that have our knowledgeable mortgage advisors.