Will cost you of a great fifteen against. 30-Season Loan

When taking aside a good fifteen-season home loan, your generally speaking need to lay currency off. How much you put off upfront hinges on their coupons and you can what you are able manage. Oftentimes, a bigger advance payment, eg 20%, makes sense, as it mode you should have a smaller sized financial much less to shell out each month. A beneficial 20% downpayment also means it’s not necessary to remove personal home loan insurance coverage (PMI).

A smaller down payment, such as for example 5% otherwise 10%, can make feel whenever applying for an excellent 15-season financing. Getting smaller down function you should buy your residence at some point instead than simply later on. A smaller sized down payment also can enables you to keep some cash in set-aside if you prefer it to cover fixes. Which have a smaller downpayment, you’ll have to shell out PMI, and therefore does enhance your own monthly home loan will set you back.

What is actually a thirty-12 months Home loan?

A 30-12 months financial lasts for thirty years, considering the loan proprietor will pay exactly as agreed, cannot make a lot more money into the mortgage and cannot re-finance they. Like with a beneficial fifteen-seasons financial, you could pay back a 30-seasons mortgage till the full term if you are paying more towards the newest dominant each month otherwise if you can afford to get it done. You can also re-finance the borrowed funds at some point when deciding to take advantageous asset of all the way down rates of interest or ideal financing terms and conditions. Good refinance you’ll stretch the mortgage identity or treat it.

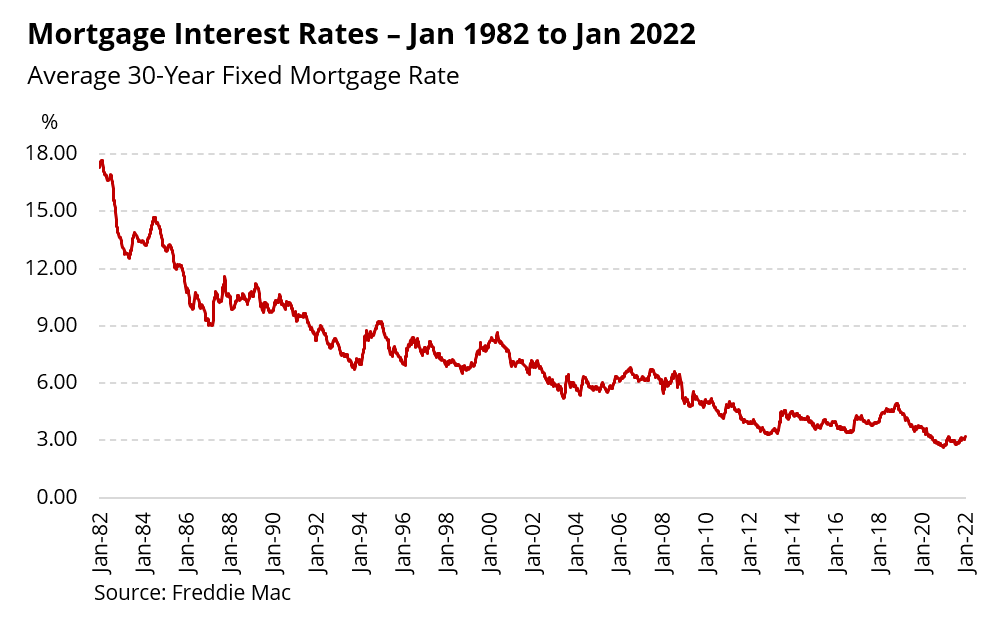

Such as for instance an excellent 15-year home loan, you might prefer a thirty-year mortgage with a predetermined interest or a changeable desire speed. A predetermined-price financial can be best if the interest levels was www.elitecashadvance.com/personal-loans-pa/hudson/ lowest when you are taking from the financing. You may be effectively securing inside the lower rate. Whatever the happens across the second 3 decades, your rate wouldn’t go up or down.

Following the basic name, taking a reduced speed into mortgage can indicate your month-to-month payments get rid of significantly

A variable rates mortgage produces feel if costs is high after you apply for the mortgage, therefore anticipate them to lose eventually. Should you get a changeable price financial when cost is actually higher, you might probably re-finance to a predetermined-rates financing when the costs fall-in the long term. In that way, you could potentially secure a lowered price on your financial.

Brand new payment toward a thirty-season mortgage utilizes the cost of the house you happen to be to find in addition to measurements of their down payment. The higher your downpayment, the low their dominant matter plus the lower your monthly payment. As with good 15-12 months mortgage, for people who set-out below 20% when buying a property with a 30-season home loan, possible most likely need to pay PMI superior, always up until you have paid down an adequate amount of the mortgage so the principal is 80% or less of new home’s value.

The majority of people discover taking out a thirty-12 months financial allows these to purchase a bigger or even more expensive home than they may afford once they picked a great 15-year mortgage. Distributed the fresh new costs out over a longer label can help you pick a property in an area who does if you don’t getting financially out-of-arrive at. This really is most likely as to the reasons 29-season mortgages be a little more preferred than just fifteen-12 months home loans.

When trying to decide between a beneficial 15-season financial and a 30-seasons home loan, it can be useful to contrast the expense of any solution. Generally, a 30-season loan will set you back less upfront but costs furthermore go out. Possible pay more upfront to have good 15-season loan but could become preserving a large amount inside the future. Listed here are components in which you’ll experience differences between such one or two mortgage types: