As an example, a loan provider might inquire to see your own taxation statements into past a couple of years

- Deposit.

- Closing costs.

- Month-to-month mortgage repayments, along with personal financial insurance rates (PMI) when you’re expected to pay they.

- Home insurance, property taxes and you can residents organization (HOA) charge if the talking about perhaps not escrowed for the mortgage repayment.

- Basic repair and you can maintenance.

- Domestic repairs and you will home improvements.

One of the biggest difficulties to own earliest-date homeowners is the down-payment. You’ll need a downpayment of at least 20% to end PMI to your a normal mortgage. PMI superior render shelter towards bank in case you standard; they can’t come-off unless you arrived at 20% guarantee in the home. This can increase their house’s month-to-month holding costs.

Having fun with home financing calculator can help you imagine monthly payments, advance payment conditions, and you may settlement costs to get a far greater sense of what you are able.

Organize Your documents

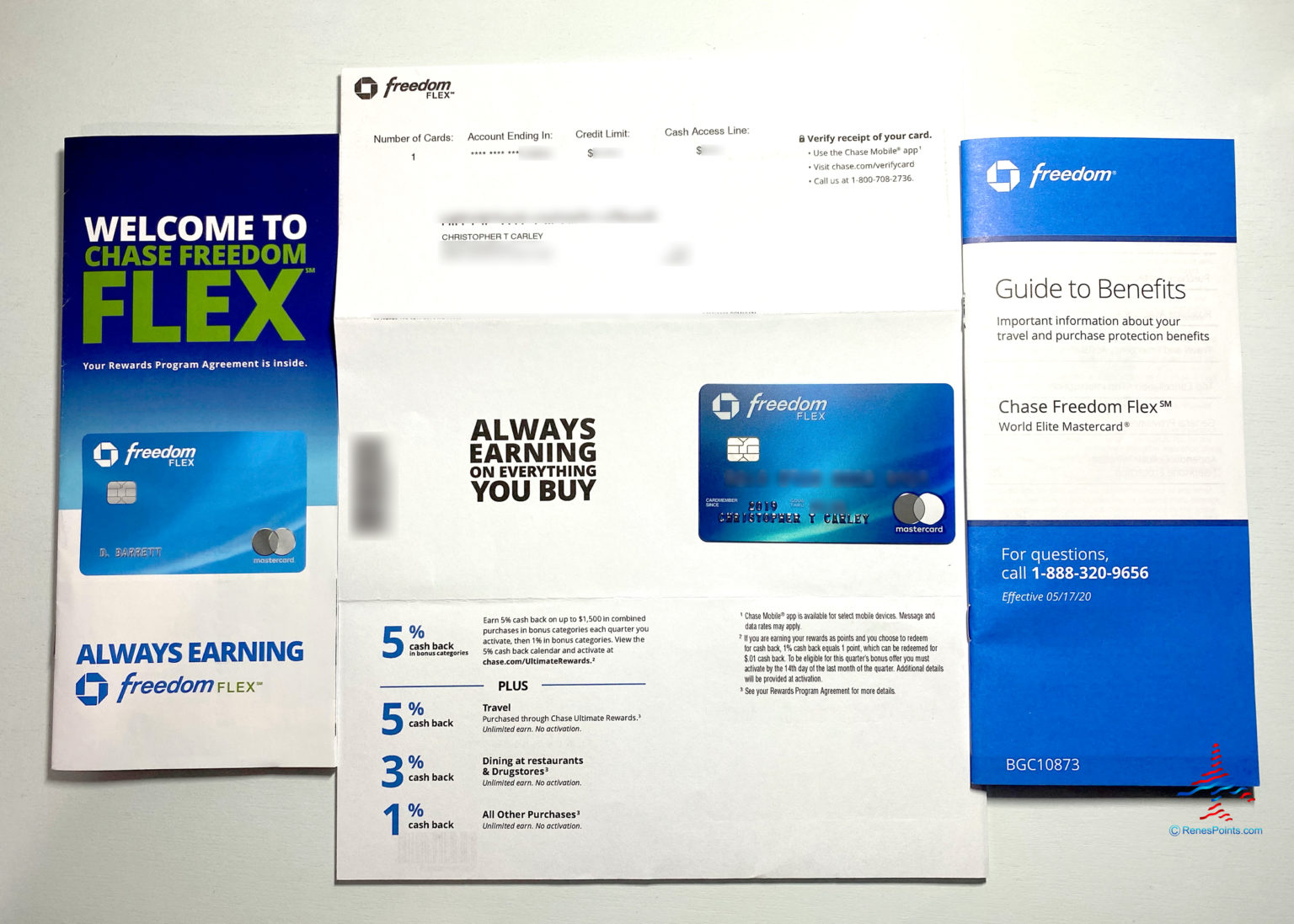

You may need multiple pieces of suggestions to try to get a beneficial financial. Prior to going into the, be prepared together with your Social Safeguards matter, the latest spend stub, paperwork of the many the money you owe, and you may about three months’ value of checking account comments and just about every other proof of property, particularly a broker account otherwise a good 401(k) working.

When you’re thinking-working, then you can need extra paperwork. You can even need to render a right up-to-big date earnings statement and you may/otherwise characters from 1 or higher self-employed subscribers attesting to your simple fact that you happen to be a different company.

Contrast Mortgage Selection

Mortgages aren’t all the same, and it’s really crucial that you understand what form of financial would be greatest when purchasing a home in your twenties. You can start of the exploring old-fashioned finance, that are supported by Federal national mortgage association otherwise Freddie Mac computer. These types of funds generally speaking require 20% as a result of prevent PMI.

Inportant

Upfront charge for the Fannie mae and you may Freddie Mac computer home loans altered in the . Charges was enhanced to own homeowners with higher fico scores, for example 740 or higher, while they was basically reduced to own homebuyers that have all the way down fico scores, like those lower than 640. Another alter: The down payment often dictate exacltly what the payment is. The better your deposit, the lower your costs, although it will still confidence your credit rating. Fannie mae has the Mortgage-Top Speed Changes toward its site.

Second, you might think Federal Casing Government (FHA) fund. Money from FHA fundamentally require smaller off repayments and also make they smoother to own consumers so you can refinance and you can transfer possession. In addition could probably qualify for an FHA financing that have a lower life expectancy credit history than what might be you’ll need for a conventional loan.

There is also the fresh U.S. Company from Veterans Products Lenders guaranty service, that is good for twentysomethings returning of armed forces service. Virtual assistant home loans make it much easier for experts to acquire and manage a house; several of their financing require no down-payment. The home you decide on, yet not, is susceptible to a rigorous examination.

Research rates to have home financing

Same as every mortgage loans aren’t the exact same, all of the loan providers are not the same. It is important to look around a variety of home loan choices which means you can be evaluate rates of interest and charges. A distinction from actually 1 / 2 of a share part you will significantly boost or ount interesting that you pay money for a home loan more the life span of your own mortgage.

And, believe taking pre-acknowledged to have a mortgage. This step concerns which have a lending company feedback your finances and leave you a great conditional provide for Go Here a loan. Pre-acceptance helps it be more straightforward to get promote accepted when your just be sure to purchase a home, and this can be specifically crucial if you’re brand new youngest buyer.