A closing Disclosure is a necessary five-webpage function that give finally information regarding the loan loan you have selected

Into the a bi-per week payment package, the mortgage servicer is actually gathering half your payment all of the two weeks, ultimately causing 26 costs over the course of the season (totaling one to extra payment annually). By making more costs and you will using your instalments into the prominent, you might be capable pay back your loan early. Before you choose a beneficial bi-weekly percentage, be sure to comment the loan conditions to find out if your would-be subject loans North Sarasota to a prepayment punishment when you do very. Find out if the servicer charges people costs for a great bi-each week payment bundle. Your elizabeth goal without having any payment by simply making a supplementary month-to-month mortgage payment from year to year.

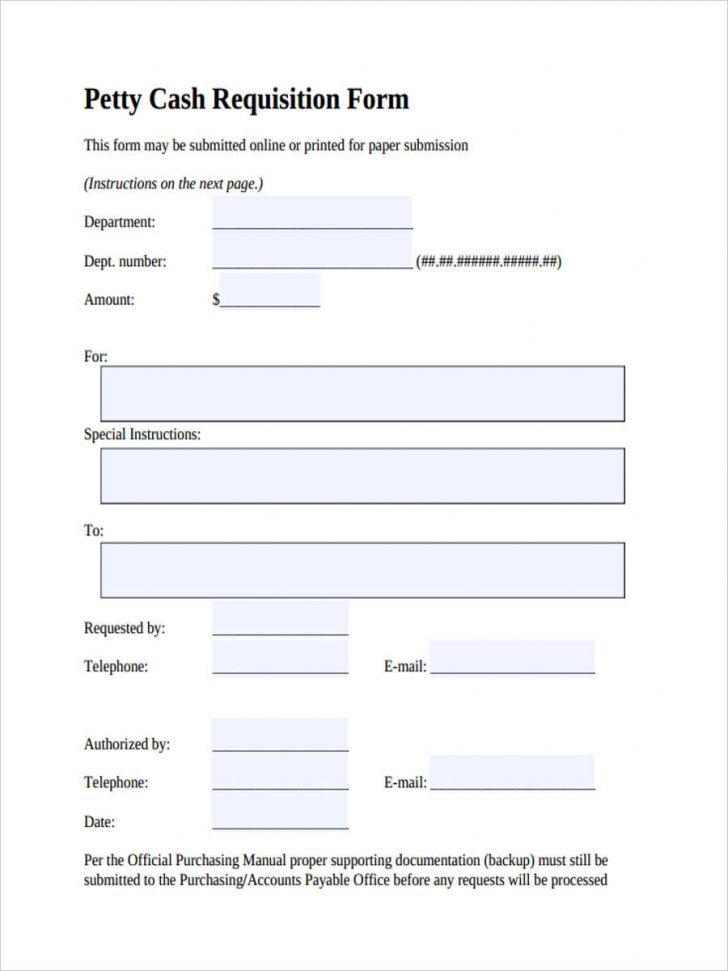

Closure Revelation

It provides the borrowed funds terminology, their projected monthly premiums, and exactly how far might shell out during the fees or other will cost you to truly get your home loan.

Framework financing

A casing financing is commonly a primary-name loan that provides loans to cover the cost of building otherwise rehabilitating a house.

Old-fashioned loan

A traditional loan is one home loan that is not covered or guaranteed from the authorities (for example below Government Houses Government, Service from Experts Issues, otherwise Company off Farming mortgage software).

Co-signer or co-debtor

Good co-signer otherwise co-borrower is actually an individual who believes when deciding to take complete obligations to invest back an interest rate with you. This individual is forced to shell out people skipped money and even the full quantity of the borrowed funds if you don’t shell out. Particular financial programs separate a co-signer as an individual who is not into the label and you will do n’t have any possession need for this new mortgaged domestic. That have a great co-signer or co-borrower on your mortgage loan offers your own lender a lot more guarantee one the loan would be reduced. But your co-signer or co-borrower’s personal credit record and money is at exposure or even repay the borrowed funds.

Credit history

A credit rating was track of your borrowing from the bank accounts and you may the reputation of investing punctually just like the revealed on the borrowing statement. Individual reporting companies, also known as credit rating organizations, assemble boost information regarding their credit record and provide they with other people, which use they build choices in regards to you. Credit historys enjoys information regarding their borrowing activity and you will most recent credit situation like your financing investing record together with status away from your own borrowing from the bank account.

Credit report

A credit history try an announcement who has details about your own credit activity and you will current borrowing situation like mortgage purchasing history additionally the condition of borrowing from the bank accounts. Lenders make use of credit scores therefore the details about your borrowing report to see whether you qualify for a loan and you will what interest to offer you.

Credit score

A credit rating forecasts exactly how more than likely you are to spend back a loan toward timepanies fool around with an analytical formula-named a scoring design-in order to make your credit rating about guidance in your credit declaration. Discover additional scoring patterns, which means you don’t possess just one credit history. Your scores count on your credit history, the kind of mortgage product, and even your day if it is actually computed.

Obligations proportion

The debt-to-earnings proportion is your own month-to-month personal debt money separated by your gross month-to-month money. So it number is a sure way lenders scale your ability to manage the fresh new monthly premiums to settle the bucks you plan to acquire.

Deed-in-lieu off foreclosures

A deed-in-lieu away from foreclosures try an arrangement where you willingly start ownership of your home to your financial to end the new foreclosures procedure. A deed-in-lieu regarding foreclosures ount kept towards financial. If you live in a condition in which you is actually in charge for any deficit, that is a difference between the property value your residence and you can the amount you still owe on the mortgage, you need to ask your bank so you’re able to waive brand new insufficiency. If for example the financial waives the fresh new lack, have the waiver on paper and maintain they for your details. A deed-in-lieu out-of foreclosure is just one particular losings mitigation.