How Property Examination Differs from This new Virtual assistant Assessment Really does Experts United Mortgage brokers Want A home We

Samantha was an authorized a home agent and you can attorney with an excellent Doc from Legislation (JD) education regarding the College or university from Missouri. With well over fifteen years of experience, this woman is seriously interested in training Pros about the Va loan process and realty best practices.

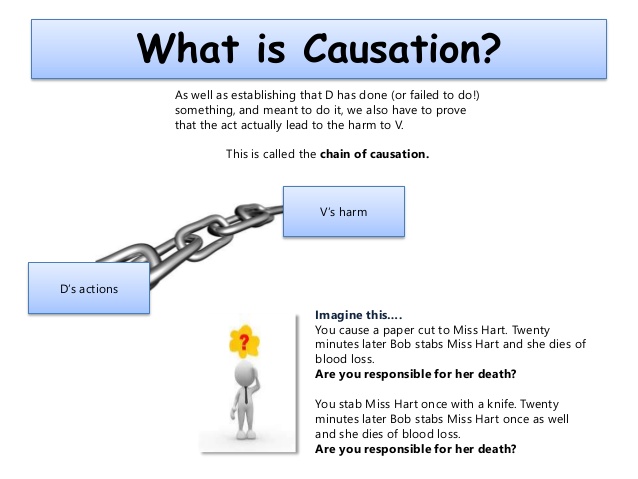

When customers start examining Virtual assistant mortgage selection, conditions such as Va assessment and you may professional house evaluation is also understandably getting muddled.

If you’re an excellent Virtual assistant appraisal and top-notch assessment vary, each keeps essential professionals to have military consumers. We have been here to ensure that you see the means and expectations of both prior to purchasing property together with your Virtual assistant mortgage work for.

Is an effective Va assessment just like a house assessment?

Zero, a Va assessment isn’t the just like a specialist home evaluation. Va appraisals and you may home inspections try one another used to examine an excellent possessions, nonetheless serve different motives and are usually held for various reasons.

An effective Va appraisal is needed to purchase a home having a beneficial Virtual assistant loan, and its no. 1 aim should be evaluate a good property’s current market worth and to guarantee the house is certified that have Virtual assistant Minimal Possessions Criteria. Homeowners are generally responsible for make payment on Va assessment percentage initial.

A home examination, simultaneously, is not required to acquire a property it is firmly demanded. It is a comprehensive and in depth report on this new home’s shape and all their solutions like the house’s build, rooftop, plumbing work, electricity, Heating and cooling and more. The cost range regarding $300 in order to $five-hundred but can are very different according to the measurements of the home and you will area.

Va Appraisal versus. Domestic Inspection

One of the main differences between a great Virtual assistant assessment and a good home examination would be the fact a property check is much more full and you will analyzes all round status of the home. That it review will help Virtual assistant homebuyers make told conclusion and you can discuss repairs or price changes ahead of finalizing our home pick.

In terms of property inspection, the newest Virtual assistant appraisal possess an incredibly narrow attention. New Virtual assistant appraiser assigns a fair market price to a home and compares the home from the VA’s MPR list.

However, if a product or service isn’t on that MPR list, there clearly was a reasonable options it won’t be mentioned toward Virtual assistant assessment declaration. It isn’t a keen appraiser’s occupations accomplish an extensive assessment out of a great residence’s most of the corner and you will cranny.

Va Assessment Number vs. Home Examination Checklist

Wish to know what exactly is covered during a good Virtual assistant mortgage appraisal and home examination? Check out at checklists less than to see the way they examine.

Domestic inspectors usually look at your ac unit, electric panels and you can driveway door openers. Any difficulties otherwise signs and symptoms of a problem will be carefully revealed and treatments shall be suggested.

Bottom line, a Virtual assistant appraisal determines new property’s value and makes sure they fits first livability standards, when you find yourself a home inspection centers on the updates and possible activities.

While there is particular convergence, an excellent Virtual assistant assessment actually an alternative choice to a property examination. Va appraisers are not domestic inspectors. They truly are per of good use devices giving various other quantities of factual statements about the home.

Can i get a property inspection which have a beneficial Virtual assistant loan?

While a beneficial Va appraisal is actually a mandatory element of protecting a good Virtual assistant mortgage, the latest assessment techniques isn’t made to offer a detailed investigation out-of every facet of the newest residence’s status.

Property evaluation you will definitely promote reveal investigation of one’s residence’s latest reputation and know potential affairs the latest assessment missed. House inspection reports is going to be a great financing having consumers planning upcoming costs and when discussing into the seller from solutions.

If you find yourself a house assessment is sold with an initial cost, this may probably save yourself several thousand dollars fundamentally by uncovering issues that may lead to pricey repairs along the line. It’s wise to look at property assessment once the an crucial an element of the homebuying techniques even after a good Va loan.

An authorized real estate professional and you will previous financing originator and you may attorney, Samantha possess insider experience writing about Va funds, from the first software and you can agreements to financing funding. She’s got over fifteen years off home sense, and you will almost three hundred,000 anybody go after their own Experienced Friendly Real estate professionals neighborhood to the Fb.

Experts United is considered a prominent Virtual assistant bank on country, unrivaled within our expertise and you will expertise in Va finance. The strict adherence to help you precision in addition to higher article criteria promises the data is predicated on thoroughly vetted, objective researchmitted to excellence, we offer advice to our state’s Experts, guaranteeing the homebuying sense are advised, smooth and you will protected having ethics.

Related Listings

The fresh new Virtual assistant financial support commission is a political fee necessary for many Va consumers. Yet not, particular Veterans is exempt, in addition to payment varies by Virtual assistant mortgage usage or other situations. Right here we mention the latest ins and outs of the fresh Va resource commission, current maps, who’s exempt and a small number of unique situations.

It will be easy to get denied to possess a house mortgage once being preapproved. Discover as to the reasons this could happens and you may what can be done to stop they.