If you find yourself stuck to the a decreased doctor mortgage with high rate of interest, this might be pricey

Thus they want to give responsibly from the precisely determining your own financial situation as well as your ability to pay any finance or borrowing it commit to bring

- Possess a high interest rate and you may related costs than the standard lenders

- Constantly want a high put

- Constantly require that you take out financial insurance in case the loan worth proportion (LVR) are more than sixty%. Mortgage home loan insurance rates helps protect the lending company while you are not able to make the next repayments.

Getting a minimal doc financial, you can promote factors instance:

At the same time, it can be more difficult for you re-finance your lower doc loan later on in the event the things alter, compared to an elementary financial.

Reduced doc money allows you to have fun with several option ways to establish your income. Figuring the more than likely income whether or not it fluctuates is a highly extremely important section of the research.

Thus they want to lend responsibly by the truthfully examining your own financial situation and your power to pay people finance or credit it commit to promote

- A signed report declaring your revenue. It’s important this statement is actually specific and practical for your age and you can industry, considering most of the current and you can coming potential affairs of your providers.

- Providers Craft (BAS) Comments for the past six otherwise one year or higher (preferably indicating broadening turnover/revenue/profits). Of a lot individuals often restrict your maximum LVR versus such statements.

- Your organization and private tax statements.

- Your business lender statements. If at all possible this will have shown the typical and confident cashflow off your business.

- An accountant’s page confirming your earnings states.

- The most recent economic comments for your business (ideally made by a keen accountant). Such as for example, profit-and-loss statements and a balance piece indicating your organizations assets and you will obligations.

The greater amount of of these you could bring that demonstrate proof large turnover (and you can money) for your needs, the better. Loan providers tend to see thinking-operating someone given that increased risk and are way more conservative within their financing techniques with these people.

Certain care about-working everyone is resource-steeped however, bucks bad. Loan providers will have to find proof their normal, confident earnings as confident that you’ll be able to generally meet your loan repayments. Also, it is perfect for them to get a hold of evidence advance loan payday Vermont of possessions that your business has generated up-over time. It means that you are reinvesting on the company which you plan for this getting available for very long. A principle is the fact your business possessions are going to be equivalent to twice your online business income, in the event this can are different because of the kind of team.

Whenever you are care about-operating, you will have an enthusiastic Australian Organization Number (ABN) and certainly will probably getting joined to have GST. In australia, it’s compulsory to own people that have a yearly revenues (i.elizabeth. turnover) in excess of $75,000 to register getting GST. Extremely lenders may wish to select facts that the business is a feasible lingering concern by having your ABN, GST subscription and associated financial statements having a period of several years or even more.

Never assume all loan providers render reduced doctor money and the ones one do have additional lending criteria. Such, they’re going to keeps more lowest paperwork criteria as well as other restriction LVRs. Their attention pricing and you may relevant fees will even are very different correctly.

Typically, even after a minimal doctor loan you ought to promote given that much verified information as you’re able to improve your chances of acceptance. you need to make sure your pointers you also provide was really-presented, real and you may totally aids your capability to make the financing money. We could assist you to do this.

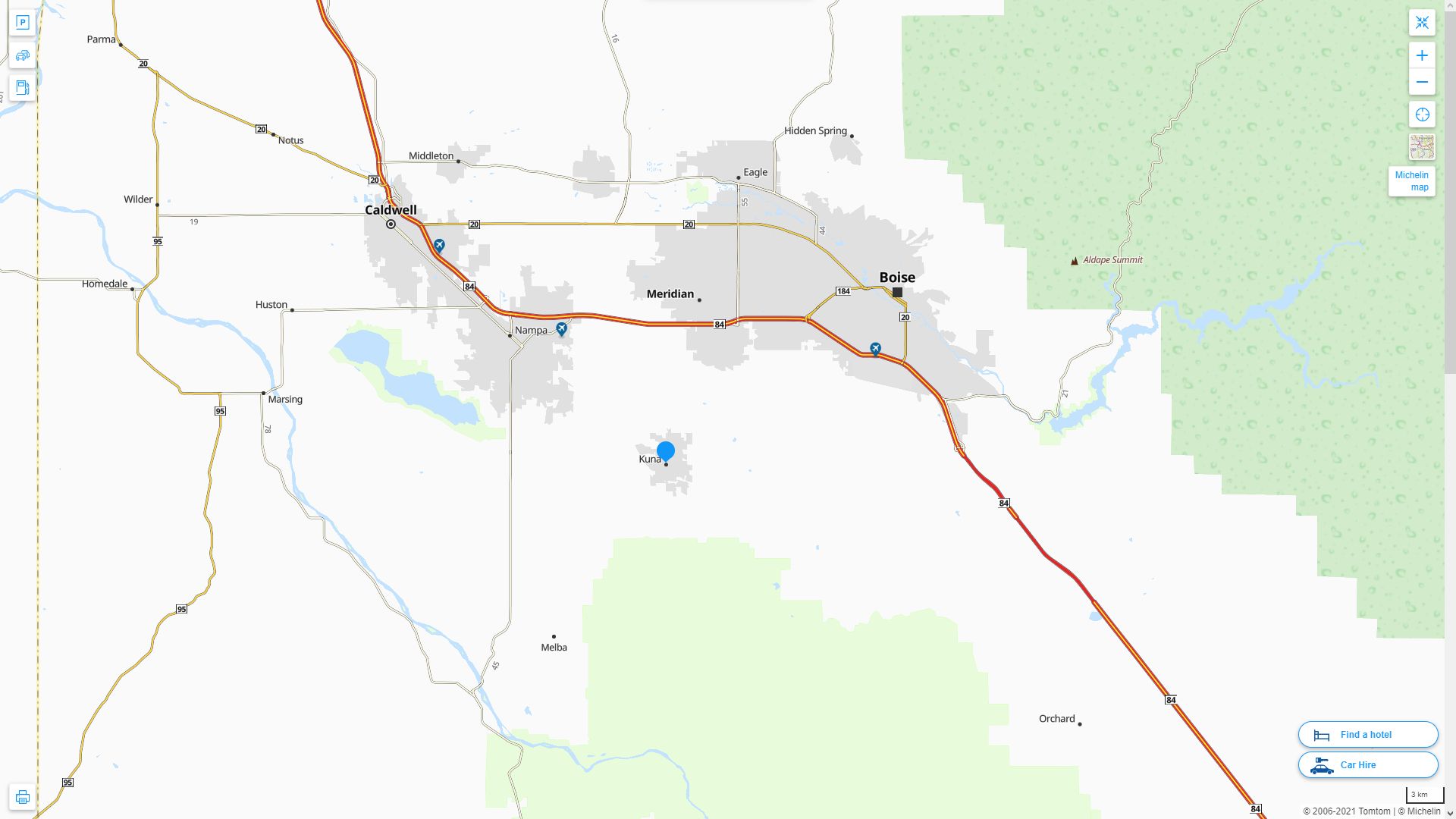

The region of the property we should buy will additionally feel a button attention towards the lender. Property within the an appealing venue isn’t as large a risk on the bank, as they may understand one to be a higher exposure because the a low doctor home loan applicant. Well-maintained land for the financial support towns are usually seen much more favorably because of the lenders than those in more remote, local places that tends to be harder for them to promote if you were to standard in your home loan repayments.

Significantly less than Australian consumer credit shelter rules, lenders are legally bound in order to follow in charge financing terms. Incapacity so you’re able to follow people conditions sells significant penalties.